Fight of the whales as $50K Bitcoin rests on ‘Coinbase costs’

Bitcoin (BTC) has currently hit $50,000 on some exchanges yet needs to get whales on its side to turn it to clear-cut assistance, data suggests.

In a tweet on Feb. 16, Ki Young Ju, Chief Executive Officer of on-chain analytics solution CryptoQuant, highlighted the so-called “Coinbase costs” as one of the last difficulties for BTC/USD.

Unfavorable costs reduces higher work

On Tuesday, a clear battle was emerging within Bitcoin trading as $50,000 remained de facto out of reach for bulls.

Assessing the premium, which pits the Coinbase BTC/USD price versus the Binance BTC/USDT set, Ki said that the till it neutralized, higher degrees would certainly continue to be unlikely.

Presently, the premium is adverse, suggesting that it is less expensive to acquire Ethereum Fee on Coinbase. The outcome is that investors, and also particularly whales, will certainly continue to accumulate. Only when the equilibrium stabilizes will certainly energy show up to deal with $50,000 even more convincingly.

” This $50k battle is about Coinbase whales( USD) vs. Stablecoin whales( USDT),” Ki wrote.

” Unfavorable Coinbase premium, however plentiful stablecoins in exchanges. Adverse premium should be cooled off to obtain another leg up.”

Exchange stablecoin equilibriums getting to new all-time highs in recent days point to a readiness to exchange for other assets. The greatest stablecoin Tether (USDT) at the same time has been accelerating its “minting” in recent months with USDT market cap currently nearing $33 billion.

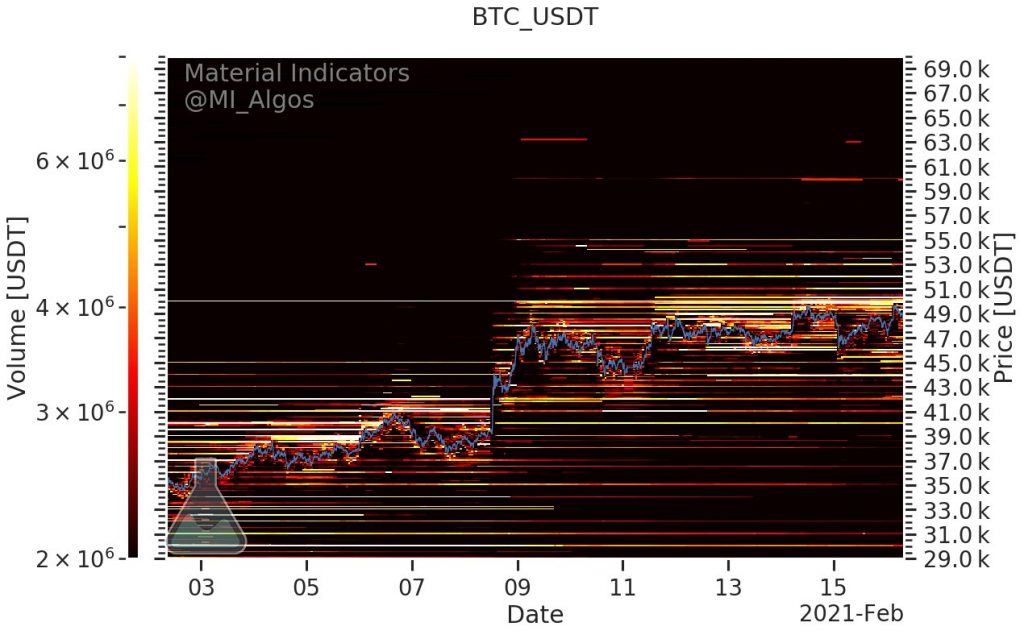

At the time of composing, whales were still lined up to sell at and also over $50,000. A check out Binance orderbook data revealed step-by-step sell orders appearing every $1,000 approximately $55,000.

No “FUD” over GBTC costs

Meanwhile, one analyst advised against misunderstanding a decrease in another premium, this time around in institutional financier circles.

Considering that the beginning of 2021, the Grayscale Bitcoin premium, which is the cost paid by investors for shares in the Grayscale Bitcoin Count On (GBTC), has actually dropped. Far from signalling minimized rate of interest in Bitcoin, the a lot more affordable buy-in opportunity is an outcome of even more shares being offered.

” A big $GBTC costs is a sign of solid demand for bitcoin. Institutional inflows right into $GBTC have been one of the biggest chauffeurs of this booming market, so every person’s eyes get on that costs. And also now that the costs has fallen down, this has actually had numerous market individuals fretted,” macro analyst Alex Krueger explained on Monday.

” The premium has actually not broken down as a result of failing need for $GBTC (in the second market), however instead because of boosting issuance– issuance skyrocketed in the last few months, helping reduce the costs with a lag. The $GBTC costs profession merely obtained too crowded.”

As Cointelegraph reported, Grayscale has been continuously upping its BTC holdings, additionally rebooting buys for Ether (ETH) in February after a virtually two-month hiatus. Since Feb. 12, it had Bitcoin assets under administration worth $31.1 billion.

Presently, the costs is unfavorable, indicating that it is cheaper to get Bitcoin on Coinbase. The result is that traders, and also specifically whales, will proceed to collect.” A huge $GBTC costs is an indicator of strong need for bitcoin. Institutional inflows right into $GBTC have been one of the biggest drivers of this bull market, so everybody’s eyes are on that costs. As well as currently that the costs has fallen down, this has actually had several market individuals fretted,” macro analyst Alex Krueger discussed on Monday.